Episodes of Retire With Ryan

Mark All

Protecting your finances from hackers is more critical than ever. Cybercriminals are getting more sophisticated, accessing sensitive information like social security numbers and attempting to steal directly from financial accounts. I recently e

Age 59 ½ is the magic age at which you can start taking distributions from retirement accounts without a penalty. This listener is wondering if he can convert part of his IRA to a Roth IRA even though he’s not 59 ½. And if he goes ahead with th

It can be overwhelming to think about what you can do to minimize your tax burden. That’s why, in last week’s episode, we covered 7 year-end tax moves for retirees. This week, we’ll tackle what those nearing retirement need to dive into at the

Tax planning—and anything related to taxes, in general—isn’t most people’s favorite topic. But because we’re getting toward the end of the year, it’s actually a great time to think about tax planning and all of its benefits. In this episode of

You’ve likely spent your entire lifetime saving for retirement. How do you make sure the money lasts as long as you do? How do you make sure you enjoy your retirement? It’s a balancing act for which there may be a solution. Matthew Jarvis is a

How much money do you need to save for retirement? $500,000? $2 million? The answer will never be the same. It’s specific to you. So how do you figure it out? In this episode of Retire with Ryan, I’ll share five steps you can follow to determin

Could Social Security become tax-free? As the political scene heats up leading up to the 2024 Presidential Elections, and both candidates make their case for election, the topic of taxation has come up. Former President Trump has promised that

Did you take out a parent PLUS loan or private loan to help your kids pay for college? Are you still struggling to pay off those loans? According to StudentAid.gov, over 9 million people over 50 have student loan debt. Of those, over 1 million

If you’ve inherited an IRA from someone who wasn’t your spouse since 2020, you can’t miss this episode. Why? The IRS has finally cleared up a lot of questions that had been left unanswered about inherited IRAs from a non-spouse. Though I’ve cov

In March, The National Association of REALTORS® (NAR) settled an antitrust lawsuit. The lawsuit alleged that NAR didn’t allow sellers to negotiate what they could pay buyer’s agents. The changes outlined in the settlement will impact “business

What steps should you take to get your financial life in order after a divorce? In this episode of Retire with Ryan I lay out, step-by-step, the checklist of things you’ll want to look over, everything from calculating your net worth to designa

In episode #211, we talked about the information you need to gather to prepare to file for divorce and the initial proceedings. But what financial steps do you need to take during a divorce? How do you figure out what life will look like on the

We’ve all heard the statistics that almost half of all marriages end in divorce. And divorce comes at a large cost. That’s why you should come up with a plan for life after divorce. Look at your net worth, put together a budget, and make projec

Why would you want to make a Roth contribution? If you believe tax rates will be higher in the future, it could benefit you. How? The contributions grow tax-deferred. When you withdraw the money, it’s tax-free. A tax-free income can be very ben

One of my favorite ways to save for retirement is through a Health Savings Account (HSA). Too many people overlook a health savings account as a great way to save for retirement and healthcare costs. So how do you get the most bang for your buc

Will your benefits be there when you need them the most? If so, should you collect your benefits as soon as possible? This is something I’m frequently asked, so much so that I decided it was time to address it. So in this episode of Retire with

What are some of the biggest tax mistakes you should be avoiding when you file taxes? CPA Steven Jarvis has worked on thousands of tax returns. He focuses on helping people who have a long-term focus. He wants to make sure his clients only pay

What are the current trends with ETFs? What’s happening in the fixed-income market? How can investors tackle current challenges? Matthew Bartolini, CFA, CAIA—the head of ETF Research at State Street Global Advisors—joins me to dissect the ETF m

How do you know if your financial advisor is delivering value? Is seeing a financial gain in your investments the only metric you should use? I’ve identified four key areas where your financial advisor should be delivering value to you: Awarene

What should you expect once you’ve hired a fee-only financial advisor? Fee-only financial advisors typically offer financial planning, investment management, or a combination of both. In this episode, I’ll cover what each process will be like

How do you find a fee-only financial advisor who’s the right fit for you? I’ve outlined a detailed process that you can use to not create a list, research your list, and interview and hire the perfect fit for you. I’ll cover it all in this epis

What are the three different types of financial advisors? Why do I believe a fee-only financial advisor is the best? If you’re considering hiring a financial advisor for the first time—or questioning if your current advisor has your best intere

I’ve spent the last 18 months writing the first book, “Fiduciary: How to Find, Hire, and Establish a Trusted Partnership with a Fee-Only Advisor,” which will officially be published on May 28th. I wrote this book to help everyone find a financi

Have you inherited an IRA from a non-spouse who passed away after 1/1/2020? Beneficiaries of pre-tax retirement accounts have always had to pay taxes on what they inherit. However, on 1/1/2020, the SECURE Act was passed, changing the annual amo

If you are divorced and approaching 62, you may qualify for social security benefits based on your ex-spouse's earning record. But who qualifies? When can you collect it? How much can you collect? Does your ex-spouse find out? I’ll answer the t

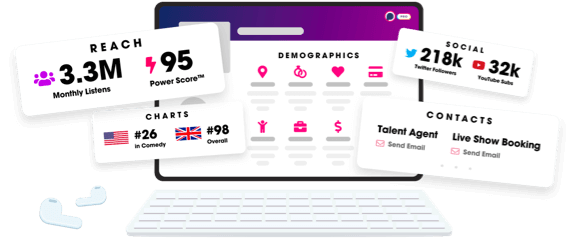

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us